Our Story

Since 1889, the story of the Wheeler has been the story of Aspen — connecting community through the arts and welcoming audiences to come be part of history.

Since 1889, the story of the Wheeler has been the story of Aspen — connecting community through the arts and welcoming audiences to come be part of history.

Opening night April 23, 1889, satin programs were scented with rose water, and the Wheeler glowed with some of the region's first electric lights. Conreid Opera Company performed "The King's Fool", followed by a squad of female fencers in a swordplay exhibition. The Aspen Daily Times raved "The citizens of Aspen are to be congratulated in the possession of so grand a structure as the Wheeler Opera House."

1841 - 1918

1841 - 1918

In 1871, Civil War veteran and third cousin of Ralph Waldo Emerson, Jerome Byron Wheeler married Harriet Macy Valentine. Making him heir to the family-owned R.H. Macy, New York City’s largest dry goods store at the time and still in operation today as Macy’s department store.

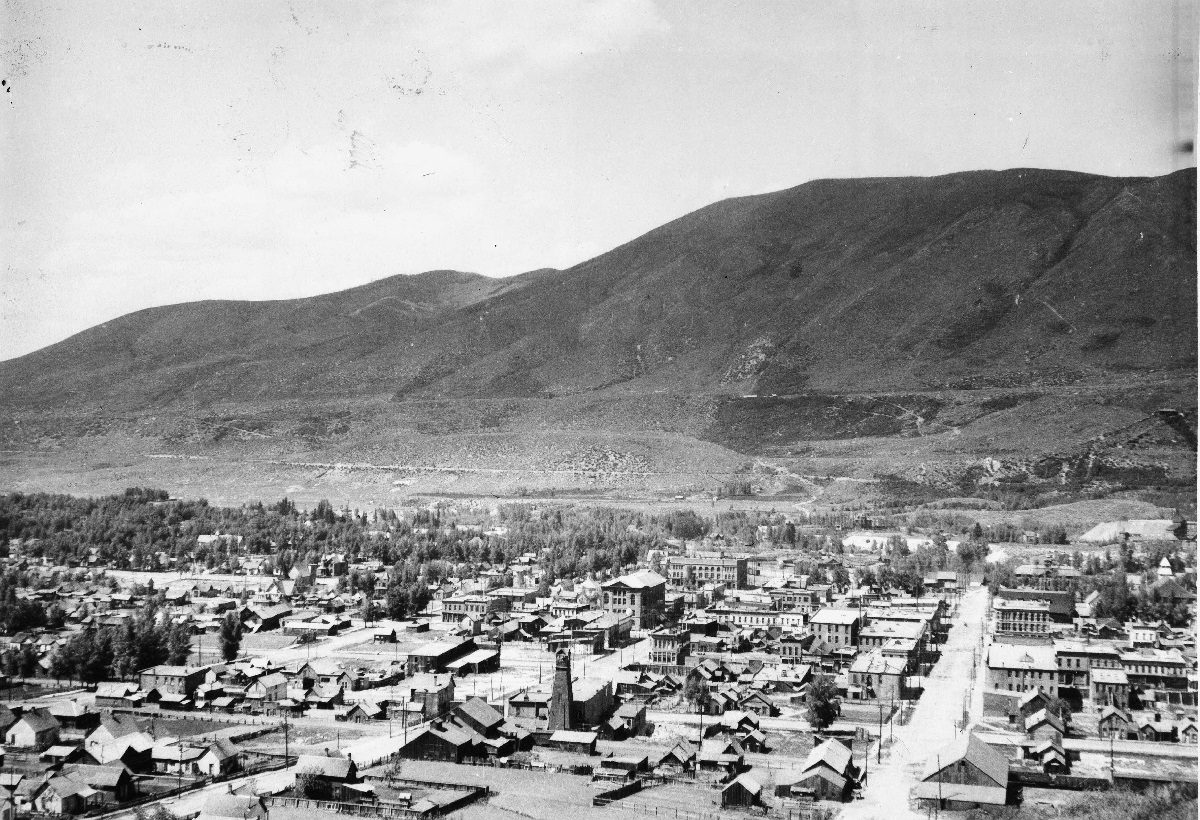

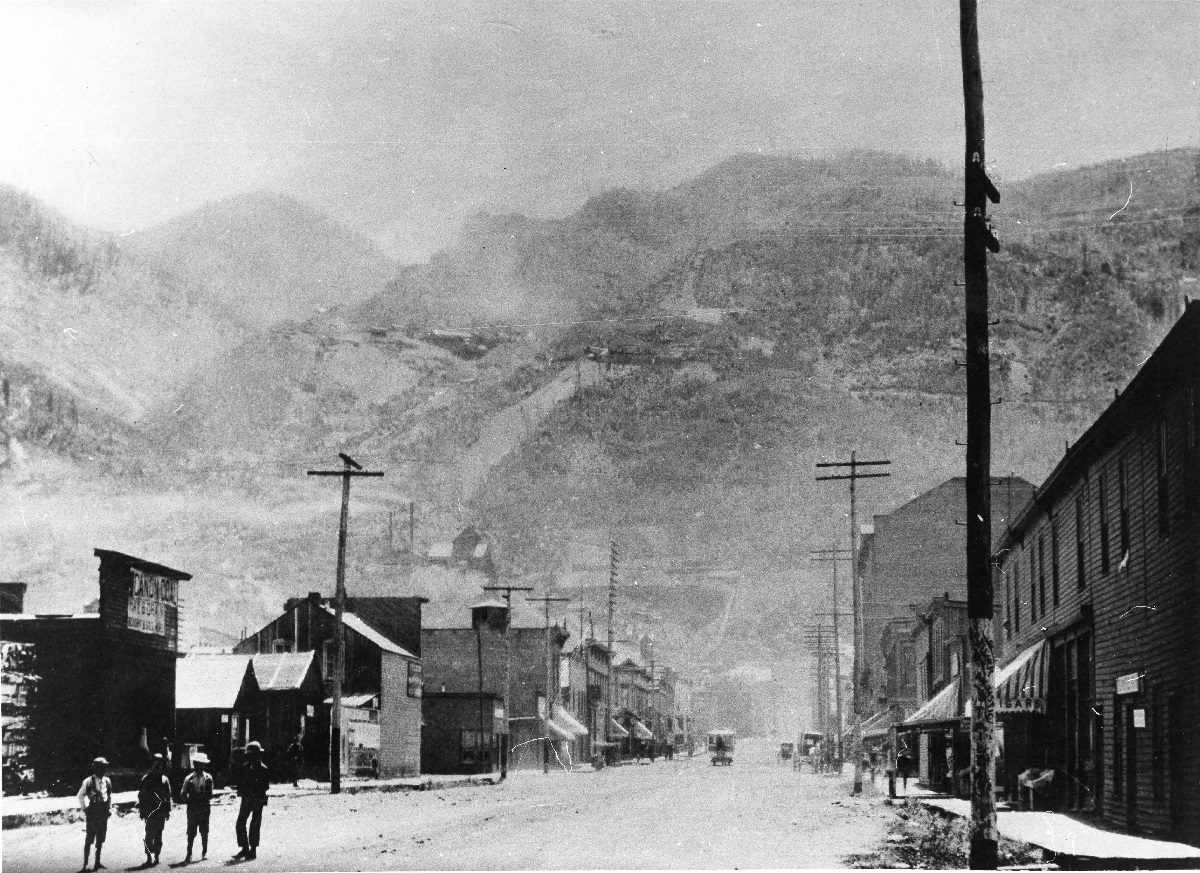

In 1883, when Harriet became ill, the couple moved to Manitou Springs, Colorado for the dry climate and healing hot springs. When Wheeler heard about the silver strikes in the mountains, he sold his interest in Macy’s and headed to Aspen. In 1889, he built the four-story sandstone Hotel Jerome, and two blocks away, the Wheeler Opera House.

1889

1889

Built with peachblow sandstone quarried from the Frying Pan valley, construction took less than a year. The building housed Wheeler’s Bank on the corner, Louis Weinberg’s Haberdashery, and The Ladies Palace of Fashion. Aspen Mining & Smelting Company shared the second floor with the bank’s offices, an attorney, and a dentist. The basement housed Aspen’s finest “tonsorial parlor,” also known as a barbershop.

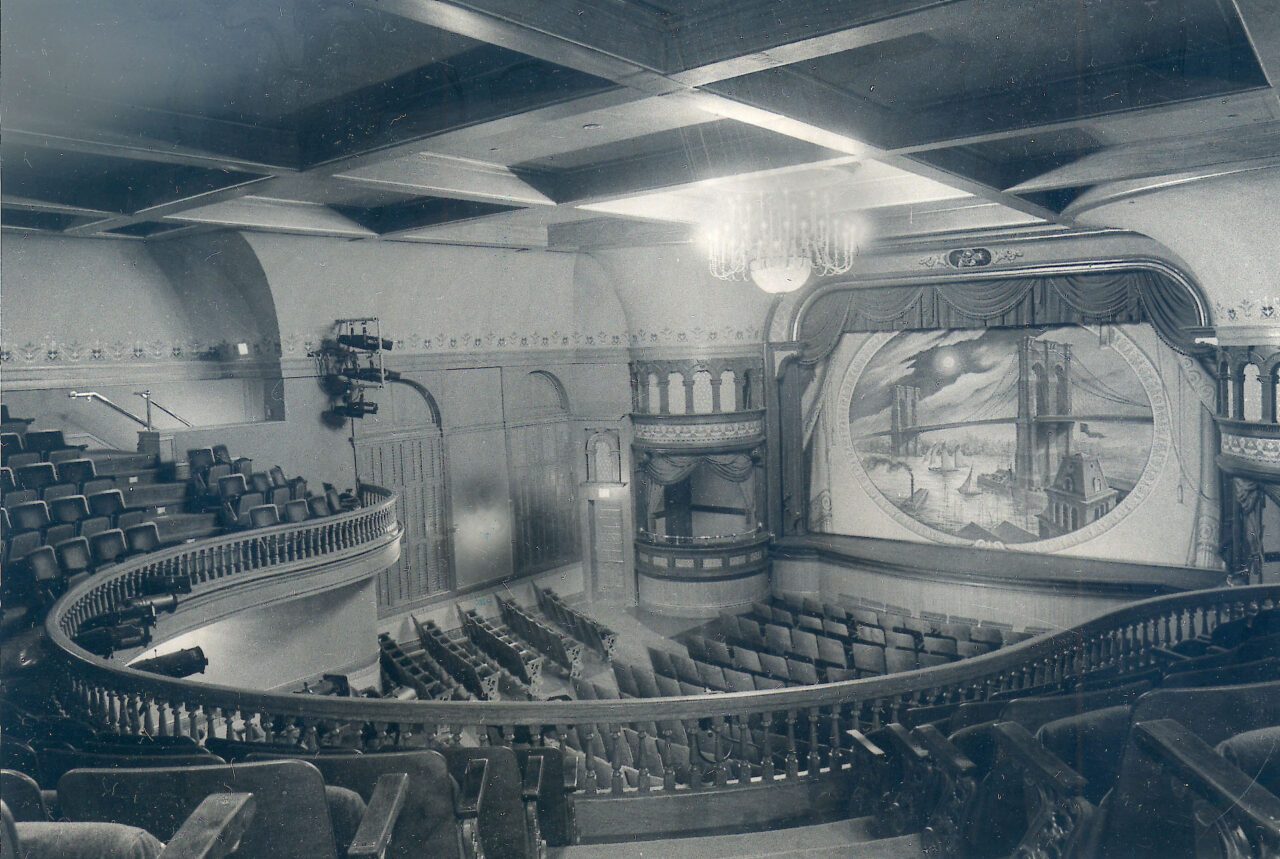

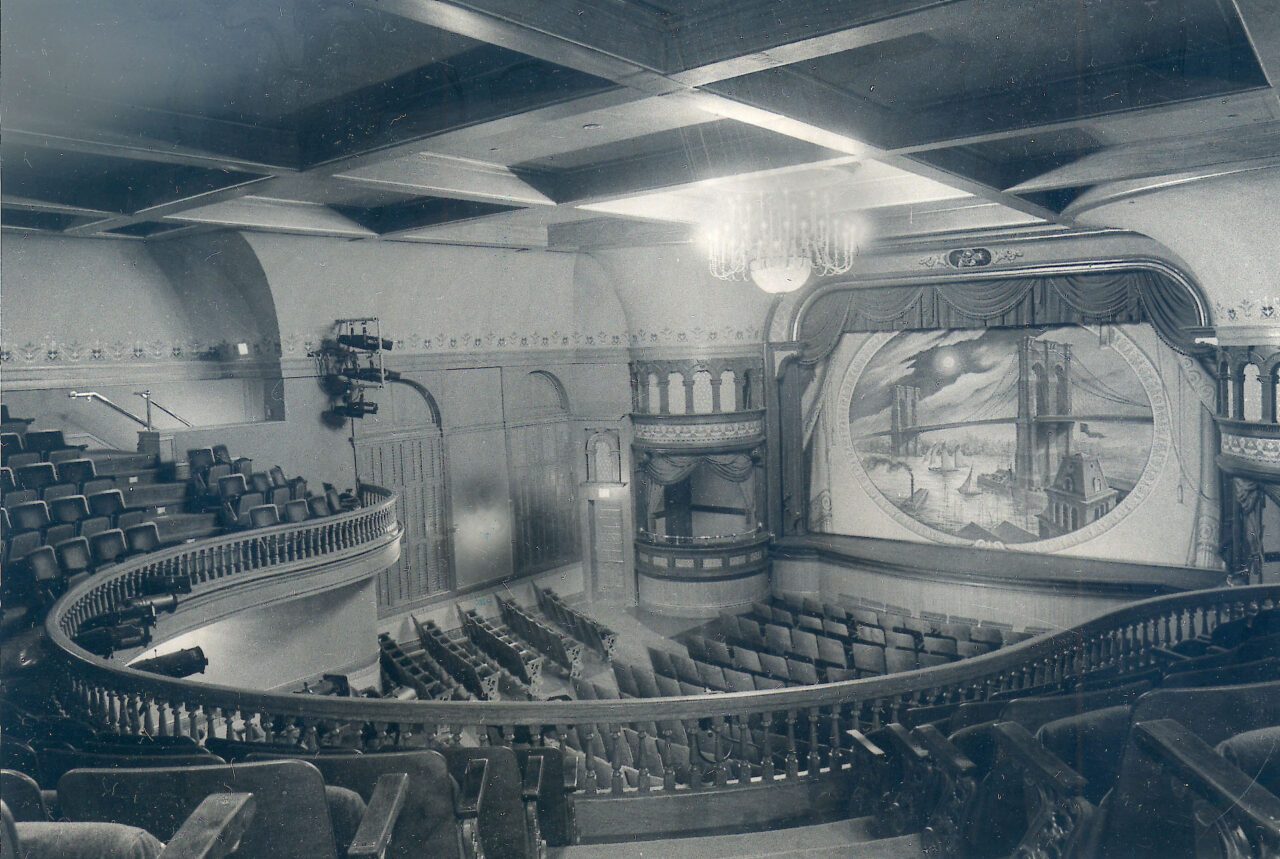

Wheeler’s gift to the community on the top floors, a public hall with a proscenium stage, seats in Moroccan leather, an azure ceiling studded with silver stars, clean steam heat, and electric lighting. Aspen was the first city west of the Divide to be wired for electricity. A buzz surrounded the Wheeler for weeks ahead of its Grand Opening Celebration. The demand for fine millinery overwhelmed local merchants to the point they took out newspaper ads declaring “We can take no more orders today, as it will tax our whole force to the utmost to complete engagements.”

1889 - 1912

Aspen joined “The Silver Circuit” touring route. A show would start in Denver, move on to Colorado Springs, then up and over to Pueblo, Trinidad, Salida, and Leadville before crossing the divide to Aspen. Then west to Utah, playing Provo City, Salt Lake City, Ogden, Park City, then up to Rock Springs, Wyoming, and ending in Cheyenne. The circuit brought traveling Shakespeare companies, minstrel shows, vaudeville, burlesques, concerts, lectures, and even boxing matches.

The U.S. Treasury was flooded with all the silver that had been mined in Aspen and other towns. In 1893, Congress repealed the Sherman Silver Act and the precious metal collapsed to true market rates. Wheeler shut down his businesses and eventually went bankrupt. The hall that only four years prior the Aspen Daily Times had declared “a perfect bijou of a theatre” had seemingly closed its final curtain.

1912 -1940

1912 -1940

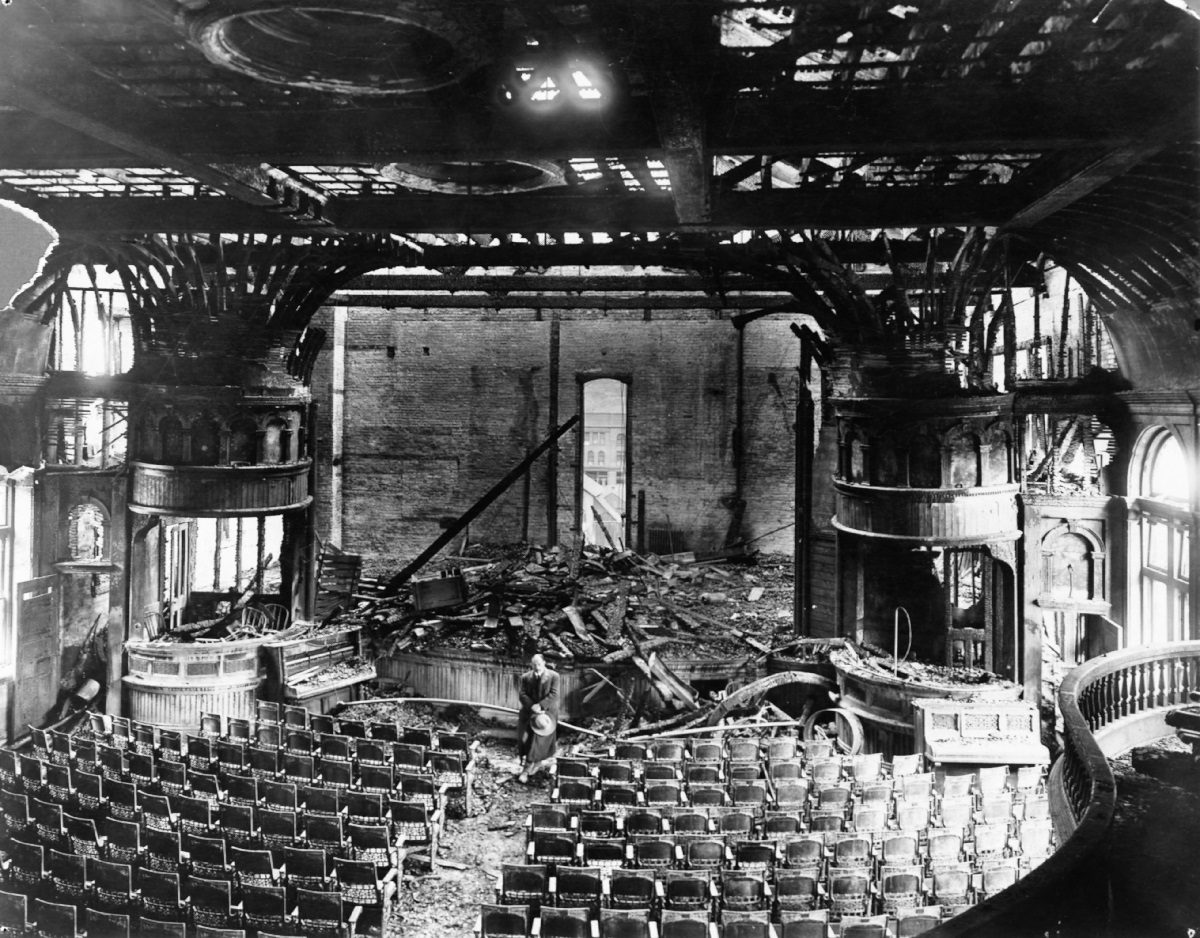

On November 12th, 1912, around 10:30 pm, just hours after a silent movie screening, a fire started between the stage floor and dressing rooms below. The fire was quickly put out, leaving water damage to the retail offices and grocery. The following night, the theatre was back to business as usual with another movie screening.

On November 21st, another fire broke out. Starting at about 2:00 am in three different locations, the box seats, the locked ushers’ room, and the scenery onstage, Aspen’s reactions were swift and vengeful. The Aspen Democrat Times ran the headline, “Fiendish Firebugs Again Rampant in Our City, Wheeler Opera House Partially Destroyed, the Prettiest Little Structure of Its Kind Between Pueblo and Salt Lake City is Sacrificed to the Venom of a Degenerate Unfit to Remain Upon Earth”.

The Wheeler Opera House, just 23 years old, was boarded up and written off as another Aspen ruin. Only the retail spaces on the first and second floors remained occupied. In 1918, the City of Aspen purchased the Wheeler Opera House for the amount of back taxes owed on the property, $1,155.

1940s - 1960s

1940s - 1960s

In the 1940s, Aspen experienced a revival with the 10th Mountain Division training at Camp Hale and the interest of Walter and Elizabeth Paepcke of Chicago. Laying the foundations for Aspen’s ski industry and the legacy of The Aspen Idea, the integration of a healthy mind, body, and spirit to nurture the whole person. In 1949, the Goethe Bicentennial Convocation led to the founding of the Aspen Institute and Aspen Music Festival.

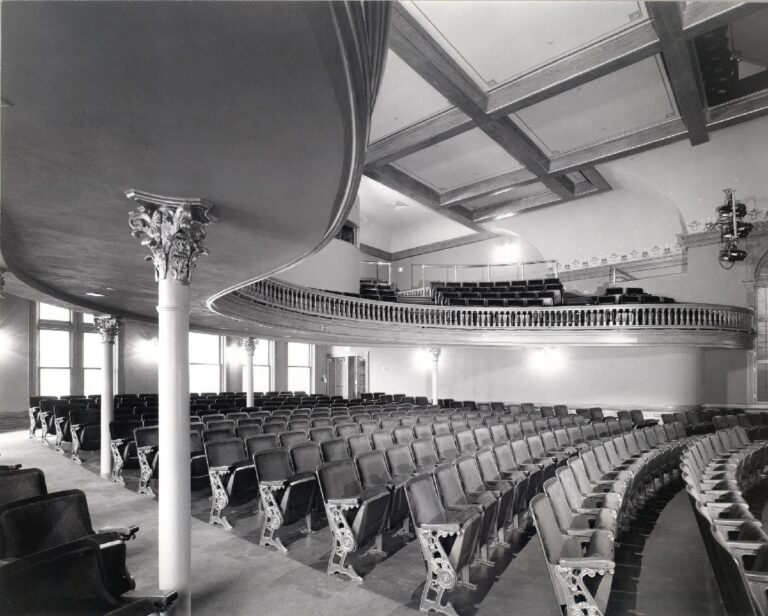

The Paepckes interest in the Wheeler sparked a communitywide effort to clean up the performance space, patch the fire-damaged walls and floors, and replace the leaking roof. Renowned architect Herbert Bayer created a spare design to include Japanese lanterns strung across the bottom of the balcony and a bare-bones stage with a simple orchestra shell. Benches provided seating and the coffered ceiling remained open, exposing the fire-charred beams.

As more visitors came to Aspen, the Wheeler’s modest renovations were no longer enough. Once again, architect Herbert Bayer took the Wheeler in a new direction, mixing the period Victorian look with a mid-century Bauhaus design. Box seats were revived as draped side stages, benches were replaced with used movie seats, and walls were painted a rich red with gold fleur de lis. A gold velvet curtain masked the stage, and the coffered ceiling was fully restored.

1970s

There were structural and safety issues as the Wheeler was coming up on its first centennial, limiting the non-summer use of the hall to the screening of classic films. In the 1970s, the Music Associates of Aspen, the corporate body of the Aspen Music Festival, led the effort for a complete structural overhaul of the Wheeler Opera House.

A visionary City Council created a mechanism for funding the Wheeler project. A one-half of one percent Real Estate Transfer Tax, or RETT, which assessed the tax to the buyers of property within the city limits of Aspen, and which was approved in 1979 for a twenty-year term beginning January 1, 1980. Voters approved an extension in May 1997, and adopted a second twenty-year term, commencing January 1, 2000, and ending December 31, 2019.

In November 2016, Aspen voters again approved and adopted a twenty-year extension, from January 1, 2020 through December 31, 2039. And in 2021, Aspenites voted to expand the purpose of the fund to support more arts and culture uses, in addition to the Wheeler.

1984

1984

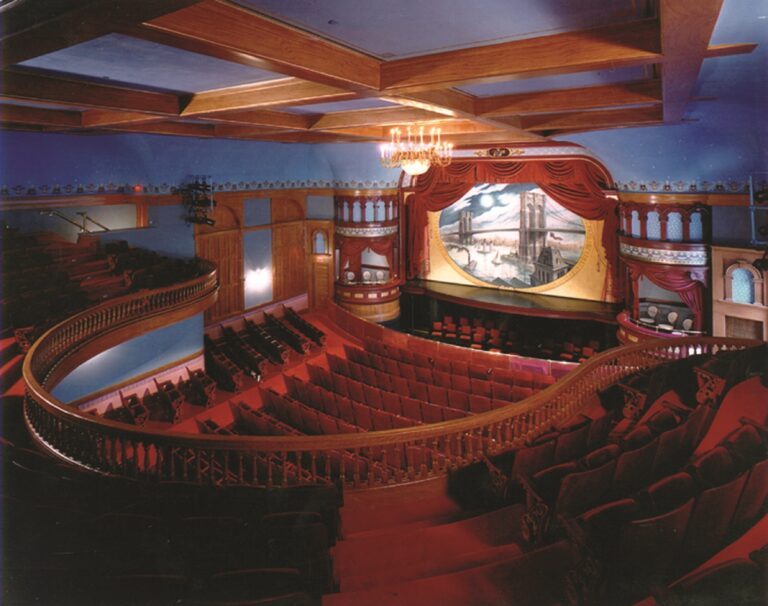

The $4.5 million restoration project would bring the Wheeler back to life. The box seats, proscenium arch, and even the Victorian-era fire curtain were returned to their original grandeur. For the first time, the second floor was established as a lobby for the theatre and to this day features a spectacular of Aspen Mountain.

Once Wheeler’s bank, the corner at street level would be a pre-and post-show theatre bar, and the space west of it was transformed into an official box office for the first time. Issues of accessibility and safety were addressed with an attached passenger elevator and a fire stair tower with a freight elevator to the stage. During this time, the Wheeler Opera House would welcome its first executive director, Robert Murray.

On May 23, 1984, the Grand Re-Opening began a week of celebration, with tours of the venue and featured performances by pianist James Levine and cellist Lynn Harrell, the Denver Repertory Theatre Company, and dance troupe Momix. A screening of the silent film classic The Wind included live accompaniment from the new orchestra pit and its star Lillian Gish, at the time ninety years old, in attendance.

1980s - 1990s

1980s - 1990s

The Wheeler was now in use year-round. After the 1984 renovation, a group of Aspen locals created the Wheeler Associates. The group helped put the theatre on the map and stepped up in purchasing much-needed technical equipment. Judy Collins, Spaulding Gray, Arturo Sandoval, Harry Connick Jr., “Sunday In The Park With George,” and a week-long run of “STOMP” are just some of the shows brought to the Wheeler.

Lily Tomlin spent six weeks fine-tuning her Broadway hit, “The Search For Signs Of Intelligent Life In the Universe,” and Aspen Community School’s annual production (one of which introduced another star, Kate Hudson). Texan Lyle Lovett came to the Wheeler at least once a year, and John Denver came by so often it was like a second living room for him. Renée Fleming’s brilliant soprano first rang out as a student of the Aspen Music Festival’s Opera Theatre program. The HBO/U.S. Comedy Arts Festival settled in for a thirteen-year run, breaking unknown talents like Lewis Black, Margaret Cho, Bill Maher, and a young comedian named Dave Chappelle.

2000s

2000s

Stewardship of the Wheeler continues through the decades. Orchestra seating was converted from American to Continental seating, eliminating side aisles. From 2010 through 2016, the Wheeler would see bottom-to-top renovations. Basement offices were reconfigured to accommodate staffing and storage needs. An entirely new balcony structure with newly configured seating, HVAC upgrades, and the transition from 35 mm to a digital cinema projection system brought significant upgrades to the theater and performance space.

In 2020, the Wheeler would embark on an exterior masonry project that lasted two years. This necessary facelift to the stonework will hopefully ensure the Wheeler stands another 135 years at the corner of Hyman and Mill, across from the fountains. A department of the City of Aspen, the Wheeler continues to carry the tradition Jerome Wheeler started. Bringing the community together in a state-of-the-art performance space.

At the Wheeler Opera House, we set the stage for connections that create memories for our audiences, artists, and greater Aspen community.

Want to learn more about the history of the Wheeler? Join us on Wednesdays at 1:30 PM for an Aspen Historical Society tour of the building. Go to events calendar for dates and details.

Learn more about Colorado's history opera houses still in operation today, visit Colorado Historic Opera House Circuit.

Curious about the 2020 Extensive Masonry project? Check out this short documentary Wheeler Opera House: A Story of Craft & Stone by Grassroots Community Network.

Historic photos courtesy of Aspen Historical Society.